The long-awaited investment plan agreed with the US on April 30 marks a pivotal step in Kyiv’s efforts to rebuild its war-torn economy, reduce reliance on legacy industries, and assert sovereignty over its natural wealth. It also reflects growing US interest in diversifying critical mineral supply chains away from China while sending a signal to Moscow about Washington’s strategic commitment to Ukraine.

The deal serves as a framework for strengthening and formalizing cooperation between Ukraine and the US, and represents a significant opportunity for Ukraine to attract investment, accelerate post-war reconstruction, and assert greater control over its economic future. While the agreement lays a strong foundation, further clarity is needed about the allocation of the fund’s resources, which will be addressed in detail in the forthcoming Limited Partnership (LP) agreement.

The scope of the fund is significant: it covers 57 mineral types, including lithium, titanium, cobalt, graphite, uranium, and rare earth elements — resources essential for clean energy, electric vehicles, defense technologies, and future-facing industries. Importantly, it only applies to new deposits, with existing operations remaining fully under Ukraine‘s control.

The fund will not impose taxes on contributions or revenues, which should help make it more attractive to investors. The preamble to the deal affirms Ukraine’s territorial integrity and full sovereignty over its resources — crucial details in the context of Russia’s continued occupation of mineral-rich regions of the country.

US Secretary of the Treasury Scott Bessent described the agreement as a tool to “pressure Russia” in peace negotiations, positioning it as part of a broader American strategy to strengthen Ukraine while countering Moscow’s influence.

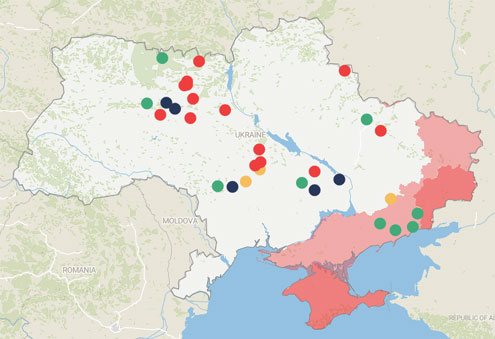

Russia has seized vast swathes of Ukraine’s natural wealth since 2014. A report by Canadian consultancy SecDev found Russian forces control about 63% of Ukraine’s coal mines and half of its manganese and rare earth deposits — resources that could otherwise support Kyiv’s recovery and integration into Western supply chains. These assets carry a “strategic and economic dimension” in Moscow’s continued aggression, according to SecDev’s Robert Muggah.

By supporting Ukraine in the extraction and commercialization of its own critical minerals, the US is seeking not only to reduce Russia’s leverage but to reshape global supply dynamics as tensions with China continue to rise.

Ukraine is one of Europe’s most mineral-rich nations, yet its potential remains largely dormant. Only about 15% of its 20,000 deposits and 117 identified minerals had been actively developed before the 2022 full-scale invasion. The country holds a third of Europe’s lithium, 7% of its titanium, and an estimated 19 million tons of graphite — potentially making it one of the top five global deposits.

This mineral wealth could form the backbone of Ukraine’s postwar reconstruction and long-term strategic autonomy. Lithium and cobalt are critical to battery and EV production; titanium is essential for aerospace and medical applications; and rare earth elements are used in everything from smartphones to missile guidance systems.

Yet extraction is capital-intensive and long-term. Industry analysts caution that most projects under the agreement could take 10 to 20 years to become operational while infrastructure destruction, legal uncertainty, and enduring security risks pose significant challenges for investors. And many of Ukraine’s mineral deposits are not yet proven to be economically viable, according to Adam Webb, Head of Battery Raw Materials at Benchmark Minerals Intelligence.

Another critical piece of the puzzle is the management and reform of Ukraine’s state-owned enterprises (SOEs), many of which operate in the natural resources sector. Historically marked by inefficiency, underinvestment, and opacity, they must be restructured to meet the transparency and governance standards demanded by Western partners and investors.

Despite years of rhetoric about reform, progress remains uneven. Many SOEs, such as those operating under the State Property Fund or the Ministry of Energy, continue to suffer from political interference, non-transparent procurement, and poor financial performance. A significant portion of Ukraine’s mining sector remains dominated by state firms that lack the technical capacity or capital to develop new resource sites.

Enterprises like oil producer Ukrnafta, and UkrGasVydobuvannya, Central and Eastern Europe’s biggest gas production company, have only partially implemented corporate governance reforms, and many extractive SOEs operate without independent supervisory boards. The lack of reliable geological data, outdated infrastructure, and corruption risks further deters foreign investment.

Efforts by the Ukrainian government to corporatize or privatize some of these entities have faced resistance and remain stalled or incomplete.

The mineral deal’s public, equal, and non-debt-based joint-fund model may serve as a prototype for future partnerships, but to succeed, Ukraine will need to accelerate SOE reforms, streamline the granting of permits, and offer robust legal protections for investors. Western support can help with this, but the initiative must come from Kyiv.

The US also views the deal as a hedge against Chinese dominance in critical minerals. China controls about 69% of global rare earth production and has used that position to impose export bans during trade disputes with Washington. The Biden and Trump administrations both prioritized the diversification of mineral supply chains to enhance national security.

Ukraine’s deposits could provide a valuable, politically aligned alternative. As noted by the Geological Investment Group, Ukraine has 117 of the 120 most-used minerals but lacks the technology and capital to exploit them. Partnering with US firms could bridge that gap while reinforcing Western resilience.

While tangible returns may take a decade or more, this mineral deal is about more than revenue. It represents a strategic bet on Ukraine’s future as a self-sufficient, democratic, and resource-secure state. It also highlights the shift in how the US and its allies are approaching global economic security — prioritizing partnerships and reducing dependence on adversaries.

If implemented with political will and strategic clarity, the agreement could redefine Ukraine’s postwar economy and anchor its place in the security and industrial architecture of the West.

This article was published by the Center for European Policy Analysis (CEPA).

Kateryna Odarchenko is a political consultant, a partner of the SIC Group Ukraine, and president of the PolitA Institute for Democracy and Development.

A specialist practicing in the field of political communication and projects, Odarchenko has practical experience in the implementation of all-Ukrainian political campaigns and party-building projects.

Serhii Kolisnyk is a Ukrainian lawyer and managing partner of the Kyiv office of Lobby Club, an international lobbying organization. He has investigated high-profile corruption and financial crimes, holding senior positions in the prosecutor’s offices of Donetsk, Sumy, Kyiv and Lviv regions, and the city of Kyiv, as well as the Prosecutor General’s Office of Ukraine, His commitment to legal innovation led him to establish the «LES» Lawyers Association in 2017 and, a year later, EcoBezpeka — Ukraine’s first environmental lawyers’ association.

Europe’s Edge is CEPA’s online journal covering critical topics on the foreign policy docket across Europe and North America. All opinions expressed on Europe’s Edge are those of the author alone and may not represent those of the institutions they represent or the Center for European Policy Analysis. CEPA maintains a strict intellectual independence policy across all its projects and publications.